Improve Your Credit Score Today.

Find out how Credit Rescue Solutions can help you enhance your credit and move toward financial independence.

Easy as 123

Receive a thorough review of your credit report from all 3 bureaus, performed by our certified experts, and gain clarity and direction on improving your credit profile.

It’s time to sign your agreement when all queries and worries have been addressed. We will go over our cancellation policy, customized programs, and disclosure agreement.

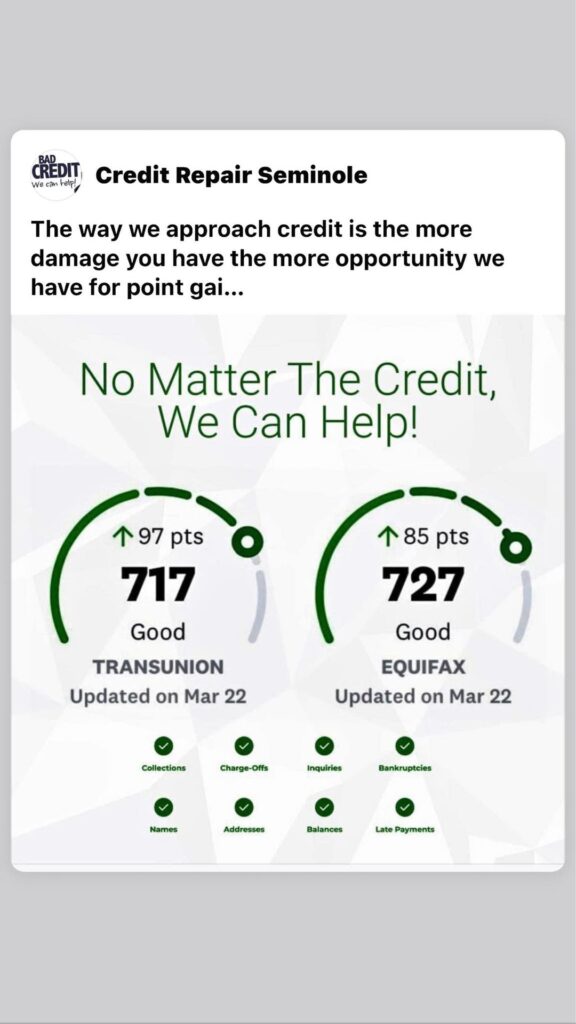

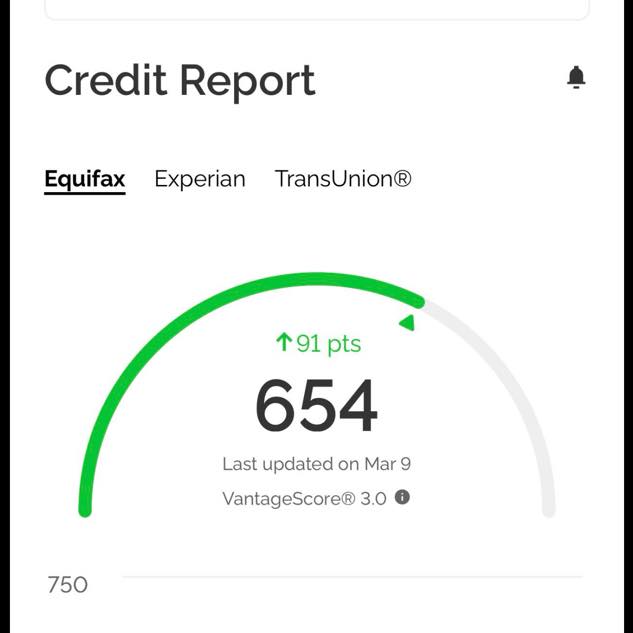

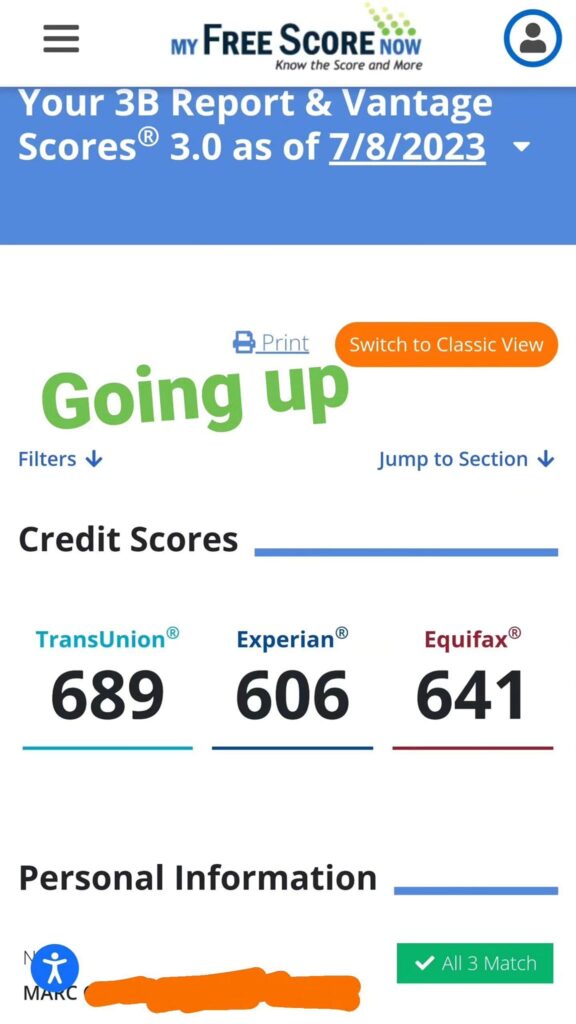

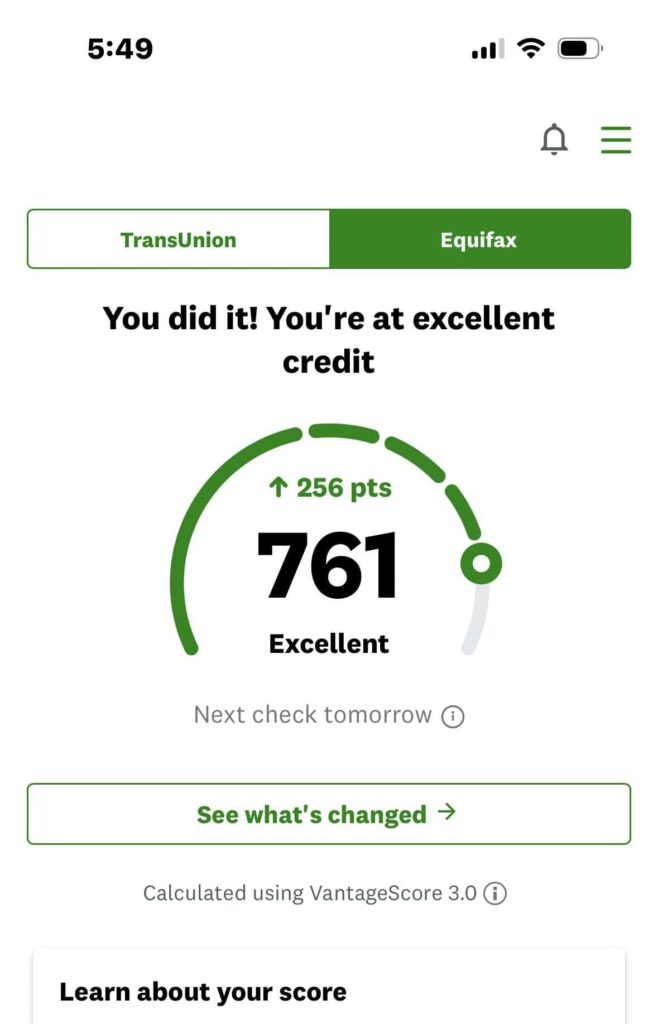

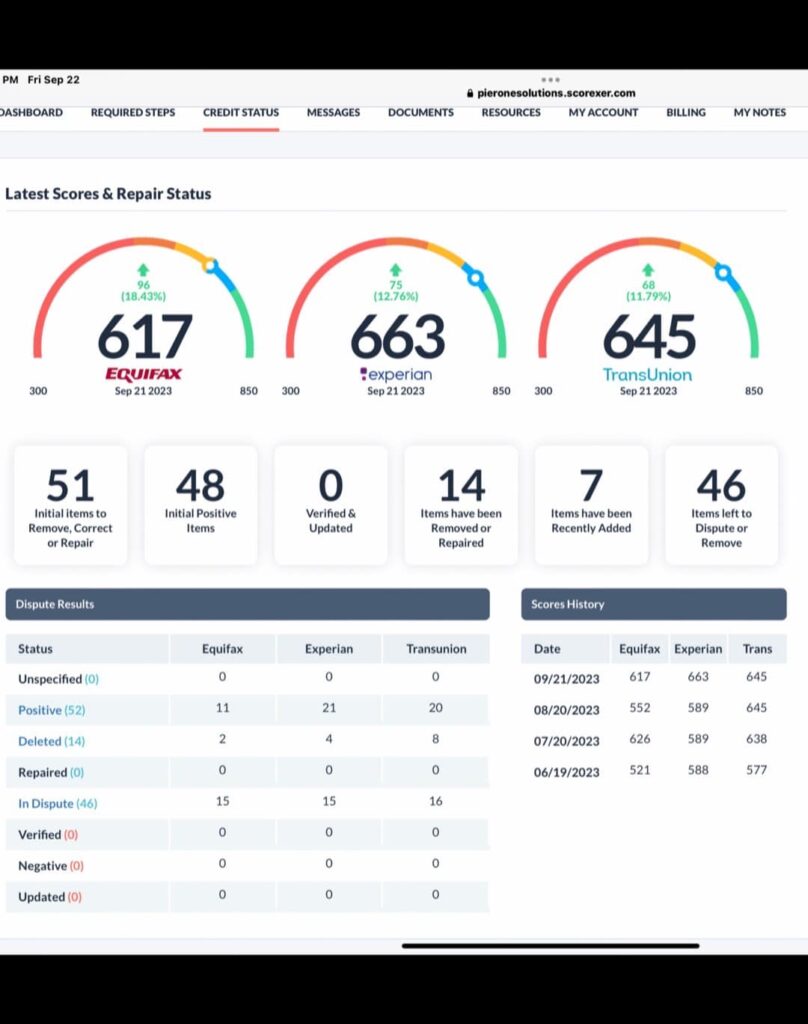

Watch as we take proactive steps to challenge negative items, optimize your credit profile, and guide you toward healthier financial habits. Witness the positive changes in your credit score quickly.

What You Get

Let the Numbers Speak for Themselves

Successfully

improved credit scores

Happy clients

of our customers

Credit scores

Why Credit Rescue Solutions?

What Sets Us Apart?

Why Choose Us?

Expertise and Commitment

Our Guarantee to You

Comprehensive Services

Experience personalized attention with our credit analysis and consultation sessions led by our Certified Credit Restoration Specialists. And with our dedicated customer support team, assistance is always just a call or email away.

Unlock the door to financial freedom with Credit Rescue Solutions. Your journey to a brighter financial future starts here.

Happy Clients!

– Jessica V.

– Jacob R.

– Loren G.

– Teresa O.

– Britney M.

– Donnie G.

Meet our CEO

Gene Ryland

As CEO of Credit Rescue Solutions, Gene Ryland oversees strategic direction, operational efficiency, and innovative solutions to empower clients on their journey to financial recovery.

FAQ’s

What type of credit repair services do you offer?

Our service handles everything for you. We review your credit report, identify inaccuracies, and leverage consumer protection laws like the Consumer Credit Act to dispute derogatory items on your behalf. You can rely on us to navigate credit complexities while you focus on your priorities.

How long does the credit repair process take?

Typically, our process ranges from 30 days to 6 months. However, timelines can vary based on the complexity and number of items we need to address on your credit report.

What kind of negative items can you help remove from my credit report?

We specialize in removing a variety of negative items, including late payments, charge-offs, collections, bankruptcies, inaccurate personal information, and hard inquiries.

Are there any guarantees that my credit score will improve?

While we can’t guarantee specific outcomes due to the unique nature of each situation, we offer a guarantee: if we don’t improve your credit score, you pay nothing.

Can I track the progress of my credit repair?

Absolutely! With our mobile app, you’ll have constant communication and real-time updates on the progress and activities related to your file. Stay informed every step of the way.

What sets your credit repair service apart from others in the industry?

Our decade-long experience collaborating with law firms ensures expert handling of disputes with creditors. We prioritize compliance, offering a hassle-free “Do It For You” approach. Plus, our proactive communication through our mobile app keeps you informed at every stage.

How do you handle disputes with credit bureaus and creditors?

We adhere to the highest standards of compliance, following the Metro 2 compliance guidelines rigorously. Our approach involves a factual disputing process under the Fair Credit Reporting Act (FCRA) to challenge inaccuracies directly on credit reports. This ensures a thorough and effective resolution of disputes with credit bureaus and creditors.